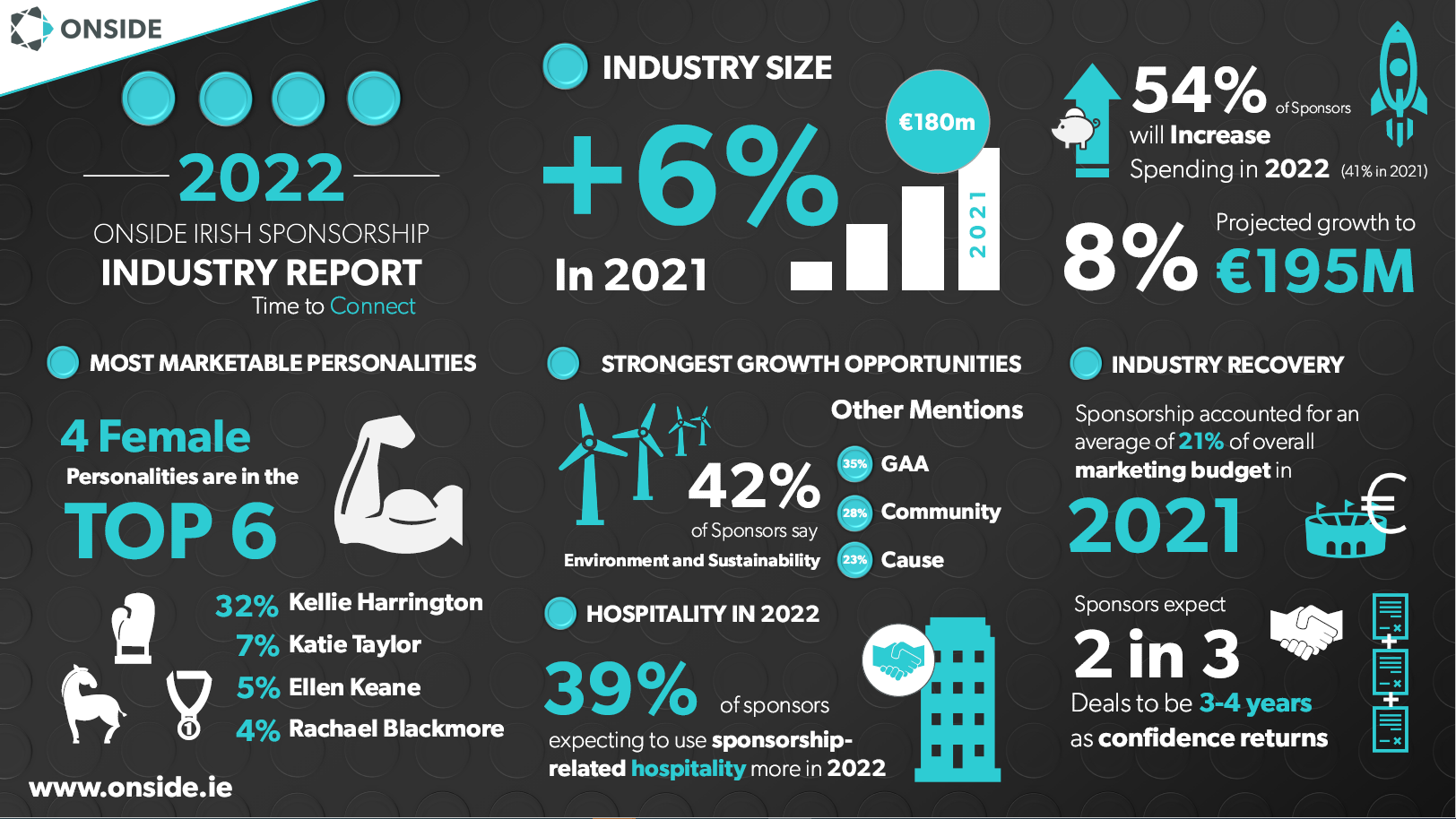

The Irish sponsorship industry grew by 6% to reach €180m in 2021, and while the sector’s size has yet to return to pre-pandemic levels, the 16th annual ONSIDE Irish Sponsorship Industry Survey estimates there will be further growth of 8% in 2022 to €195m, a step closer to the €200m threshold first reached in 2018.

54% of sponsors will be increasing their sponsorship investment levels in 2022, up from 41% in 2021, and 70% expect sponsorship spending across the industry to increase, compared to only 1 in 5 last year.

According to John Trainor, Founder and CEO of ONSIDE: “The pandemic affected all marketing activity, but after the initial shock in 2020, sponsorship has once again proved its worth to brands seeking to build new and better connections. The immediate decline was less steep than advertising and other parts of the marketing mix and its recovery has been steady and sustainable – much as we saw during the financial crisis earlier this century”.

Trainor adds: “The most interesting part of this recovery story to date is a noticeable shift in the business case for investment in sponsorship. Sponsor objectives are shifting to revolve around brand image (42%) and showcasing community and social responsibility (39%), overtaking brand awareness goals (34%) for the first time in 2022. This year, we have seen a significant increase in brands using sponsorship to connect to the diversity and inclusion aspects of their businesses and environmental sustainability platforms have surfaced in our research as the strongest growth opportunity in sponsorship in the minds of 42% of budget holders.”

Commanding 1 in every 5 Euro of Ireland’s marketing and communications investment in 2021, the consultants expect that 2 in 3 deals built in 2022 will be 3–4-year terms, as belief in the longer term return on this investment stood the boardroom tests of Covid scrutiny.

Ellen Keane (centre) is one of four female athletes at the top of the list of ONSIDE’s most marketable personalities for 2022. Keane is pictured alongside ONSIDE Strategic Advisor and GAA hurling legend Joe Canning (L) and ONSIDE Founder and Chief Executive John Trainor (R)

2021 was a breakthrough year for women’s sport in Ireland and 9 out of 10 sponsors see women’s sport as a significant opportunity this year, up from 8 out of 10 last year. 63% of industry professionals surveyed selected a female as their most marketable personality for 2022, up 28% on 2021, with Kellie Harrington, Katie Taylor, Ellen Keane, and Rachael Blackmore leading the way. After several years in the shadows, there were green shoots of optimism for soccer, with both women’s captain Katie McCabe and men’s goalkeeper Gavin Bazunu also making the industry’s 2022 top prospects list for the first time.

Reflecting on the standard of activity produced by the collective Irish sponsorship industry last year, over a quarter of industry experts think sponsorship campaigns in Ireland were more effective in 2021 than 2020, +6% year on year. According to the industry professionals surveyed, GAA and Rugby partnerships were most worthy of recognition, as Lidl and SuperValu’s ties with gaelic games stood alongside Vodafone and Guinness’s rugby partnerships as perceived best in class of ‘21. Sky’s new partnership with the Ireland women’s soccer team was also a notable new entry to this year’s list.

Sport also dominates the survey list of the most effective rights holder partners in the eyes of sponsors, with the IRFU leading the line alongside the GAA, the Olympic Federation of Ireland and Horse Racing Ireland. They are joined on that list this year by the Guinness Cork Jazz Festival, which made a triumphant return in 2021, and which Trainor flags “is an important reminder of the opportunities that will be available as more festivals and the wider entertainment sector rejuvenate throughout 2022.”

Some good news for the hard-hit hospitality industry sees 39% of sponsors expecting to use sponsorship-related hospitality more in 2022, up 24% on last year. Experiential marketing is also showing significant growing appeal, with 51% of sponsors indicating they will use it more to leverage their sponsorship programs this year, up 28% year on year.

Building on some notable new Irish venue naming rights deals in 2021 including The 3Olympia and provincial stadia like the NUIG Air Dome, pitch and club ground naming rights for rugby and GAA looks set to continue, with 3 in 10 rights holders actively exploring options around selling venue naming rights in 2022, a level higher than found pre-pandemic in 2019.

Challenges to the industry uncovered by the ONSIDE research include the range of sectors that will come under increased scrutiny by government and other interest groups. In terms of self-governance, an increasing number of rights holders are likely to employ self-imposed bans across sectors including betting (up 17%), foods that are high in fat, sugar and salt (up 15%) and electronic cigarettes (up 6%).

ONSIDE Founder and Chief Executive John Trainor estimates Ireland’s sponsorship industry will grow by 8% in 2022.

Trainor concludes: “A few eye-catching new mega sports deals are ready to be announced this quarter in rugby and golf, while established sectors including retail / supermarkets and banking / insurance will be key drivers of solid year-long 2022 growth. Any unforeseen spike in spend may come from the pace at which sectors we are tracking investing in sponsorship in other parts of the world in 2021 start to impact the Irish market in 2022, particularly in relation to cryptocurrency trading, other blockchain-backed technologies and the more general momentum towards the metaverse and Web3”.

The ONSIDE Irish Sponsorship Industry Report 2022 is a survey of key industry stakeholders in the Irish sponsorship market. The respected barometer conducted annually since 2007 gathers insights on the state of the sponsorship industry in Ireland, tracking sponsor and rights holder spend, investment, strategy and opinion.

ONSIDE is a leading specialist in marketing and sponsorship consulting and research services — with a proven track record and strong industry experience in a cross section of sectors, ONSIDE is currently feeding into the marketing and sponsorship decision making of c. €50m+ of Irish spend — working on many of Ireland’s premier sponsorships — on sporting, music, cause-related, broadcast and other platforms.